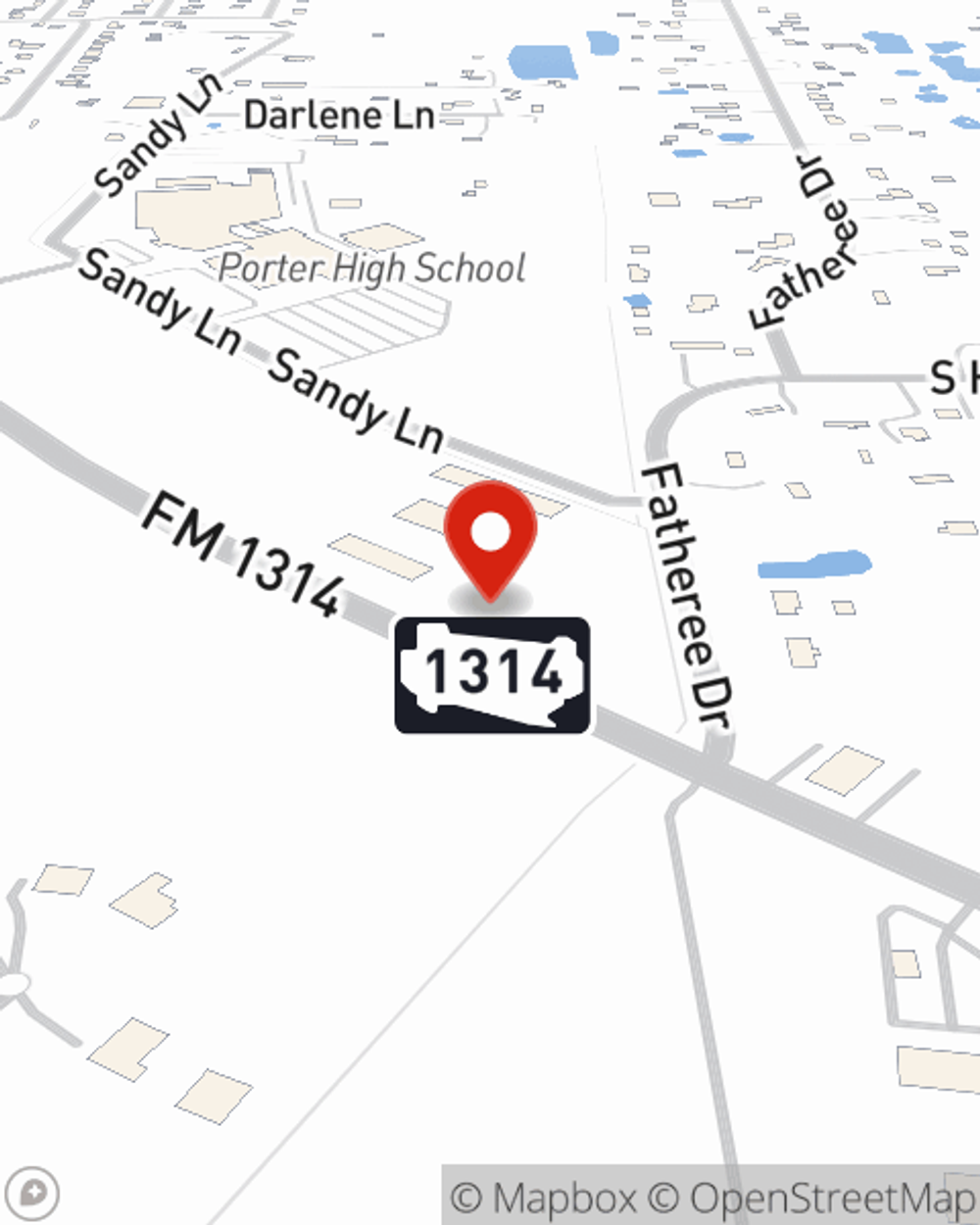

Auto Insurance in and around Porter

Porter's first choice car insurance is right here

Let's hit the road, wisely

Would you like to create a personalized auto quote?

Insure For Smooth Driving

Whether it's a sedan or an electric vehicle, your vehicle could need outstanding coverage for the valuable work it contributes to keep you moving. And especially when the unanticipated happens, it can be important to have the right insurance for this significant part of your daily living.

Porter's first choice car insurance is right here

Let's hit the road, wisely

Auto Coverage Options To Fit Your Needs

Your vehicle will thank you for making sure you're prepared with State Farm insurance. This can look like liability coverage, emergency road service coverage and/or uninsured motor vehicle coverage, and more. That's not all! There are also a variety of savings options including the good driver discount, Steer Clear® and Drive Safe & Save™.

Porter drivers, are you ready to see what the State Farm brand can do for you? Get in touch with State Farm Agent Eric Wiggins today.

Have More Questions About Auto Insurance?

Call Eric at (281) 601-4073 or visit our FAQ page.

Simple Insights®

Boating safety tips

Boating safety tips

Before you set sail and venture into the open waters, learn the essentials of boat safety.

What does liability insurance cover?

What does liability insurance cover?

Discover what liability car insurance covers, including bodily injury (BI) and property damage (PD), with examples of covered expenses.

Eric Wiggins

State Farm® Insurance AgentSimple Insights®

Boating safety tips

Boating safety tips

Before you set sail and venture into the open waters, learn the essentials of boat safety.

What does liability insurance cover?

What does liability insurance cover?

Discover what liability car insurance covers, including bodily injury (BI) and property damage (PD), with examples of covered expenses.